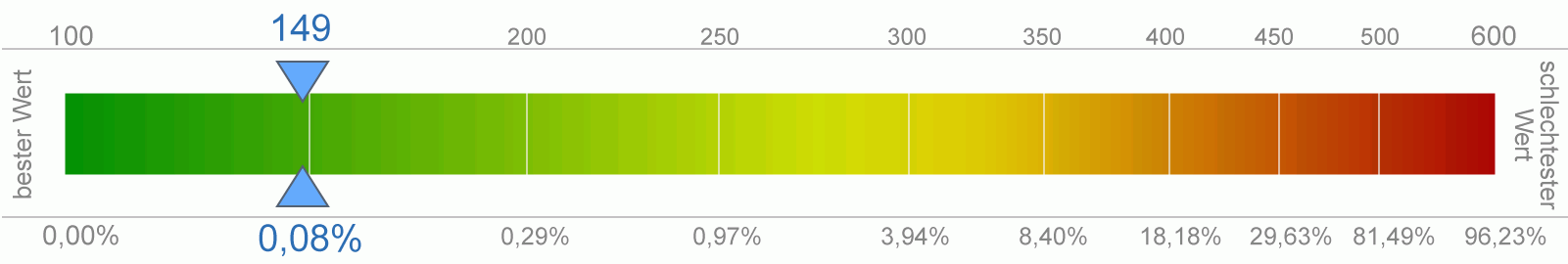

ARE Deutzen GmbH has an excellent credit rating.

Companies can only operate if they are able to satisfy outstanding payments at all times. We have established a rigorous system of liquidity management to protect our credit rating and to guarantee our operations as a going concern at all times. It ensures that adequate liquid funds are available at the right time – and that ultimately they are used for the right purposes.

ARE Deutzen GmbH has an impressive balance sheet with an above-average equity ratio, accompanied by an excellent financial infrastructure. We submit our balance sheet figures promptly and regularly to external rating agencies. The credit indicators determined by external third parties and our Creditreform certification reliably demonstrate that ARE Deutzen GmbH will remain a trustworthy partner to its customers, partners and employees in the medium to long-term.